|

|||||||

|

| Submit Tools | Thread Tools | Search this Thread | Display Modes |

|

#1

|

|||

|

|||

|

Forex Technical & Market Analysis FXCC Nov 13 2013

[b]Forex Technical & Market Analysis FXCC Nov 13 2013

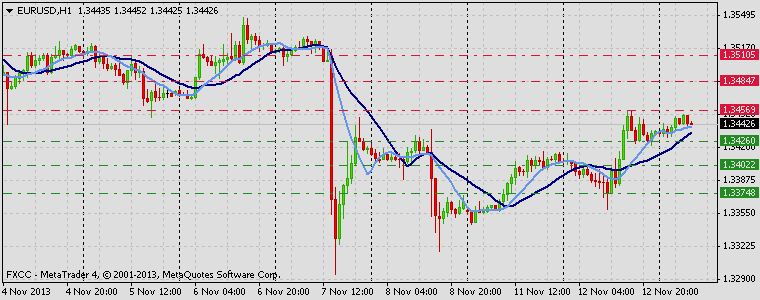

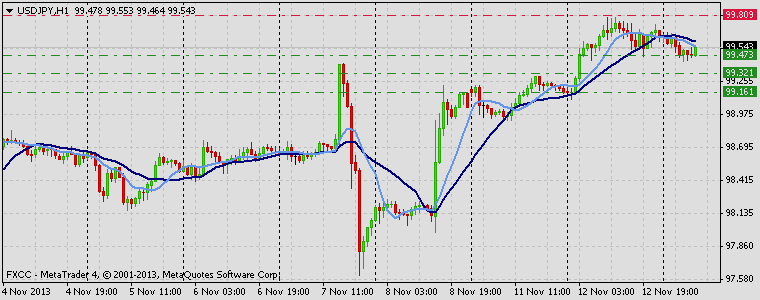

Japan's preliminary GDP figures are expected in up 0.4% as Ben Bernanke gives a speech European markets take centre stage on Wednesday, the UK's claimant count data is published, with the rate of unemployment scheduled to fall to 7.6% of the workforce. Industrial production for Europe is scheduled to fall by 0.2%. Later the BoE governor Carney delivers the bank's quarterly inflation report. Later on the German Bundesbank president Weidmann speaks and despite the German central bank not being in control of its money supply, or interest rate setting, the bank is still amongst the most respected banking institutions globally. The USA federal budget balance is scheduled to deliver what many may consider a rogue outlier number, predictions suggest a figure of -$103 billion will be published when last months' figure was a positive $73 billion. Later on in the late evening trading session we receive New Zealand's retail sales figures expected in at 0.9%. Thereafter Japan's preliminary GDP figure is expected to print at 0.4%. The Fed chairman Ben Bernanke gives a speech, whilst China reveals its percentage rise in foreign firms' investments and finally Japan delivers it's revised industrial prod ruins figures expected in at 1.5% up month on month. Looking towards the opening sessions on Wednesday the DJIA future is down 0.07%, SPX down 0.14% and the NASDAQ up 0.31%. European indices look weak; STOXX down 0.59%, DAX down 0.37%, CAC down 0.60% and UK FTSE down 0.14%. NYMEX WTI oil closed the day down 2.18% at $93.07 per barrel. NYMEX nat gas was up 2.01% on the day at $3.65 per therm. COMEX gold closed the day down 1.09% at $1267.20 per ounce with silver down 2.69% at $20.71 per ounce. FOREX ECONOMIC CALENDAR : 2013-11-13 09:30 GMT | UK.ILO Unemployment Rate (3M) (Sep) 2013-11-13 10:00 GMT | EU.Industrial Production w.d.a. (YoY) (Sep) 2013-11-13 10:30 GMT | UK.Bank of England Quarterly Inflation Report 2013-11-13 12:00 GMT | US.MBA Mortgage Applications (Nov 8) FOREX NEWS : 2013-11-13 05:50 GMT | EUR/USD edges higher; momentum bias still negative 2013-11-13 05:03 GMT | AUD/CHF slightly higher; both components under pressure 2013-11-13 04:40 GMT | GBP/JPY back down at 158 after failing to conquer 159 for days 2013-11-13 04:19 GMT | EUR/JPY in consolidation mode ------------------- EURUSD : HIGH 1.34525 LOW 1.34296 BID 1.34427 ASK 1.34429 CHANGE 0.05% TIME 07 : 58:31  OUTLOOK SUMMARY : Up TREND CONDITION : Down trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: Next barrier on the upside lie at 1.3456 (R1). Surpassing of this level might enable our initial target at 1.3484 (R2) and any further gains would then be limited to last resistive structure at 1.3510 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 1.3426 (S1). Clearance here would suggest lower targets at 1.3402 (S2) and 1.3374 (S3) in potential. Resistance Levels: 1.3456, 1.3484, 1.3510 Support Levels: 1.3426, 1.3402, 1.3374 ------------------------- GBPUSD : HIGH 1.59073 LOW 1.58855 BID 1.58930 ASK 1.58933 CHANGE -0.08% TIME 07:58:32  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: Possibility of market strengthening is seen above the resistance level at 1.5919 (R1). Clearance here is required to validate next interim target at 1.5938 (R2) and any further rise would then be targeting mark at 1.5962 (R3). Downwards scenario: Risk of market decline is seen below the next support level at 1.5888 (S1). Loss here might downgrade currency rate towards to the next supportive means at 1.5866 (S2) and 1.5848 (S3) in potential. Resistance Levels: 1.5919, 1.5938, 1.5962 Support Levels: 1.5888, 1.5866, 1.5848 -------------------------- USDJPY : HIGH 99.673 LOW 99.428 BID 99.519 ASK 99.521 CHANGE -0.11% TIME 07 : 58:32  OUTLOOK SUMMARY : Down TREND CONDITION : Up trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Next hurdle on the upside is seen at important technical level |

|

«

Previous Thread

|

Next Thread

»

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | Search this Thread |

| Display Modes | |

|

|

All times are GMT -5. The time now is 05:04 PM.

Linear Mode

Linear Mode