|

|||||||

|

| Submit Tools | Thread Tools | Search this Thread | Display Modes |

|

#1

|

|||

|

|||

|

Forex Technical & Market Analysis FXCC Jun 06 2013

[b]Forex Technical & Market Analysis FXCC Jun 06 2013

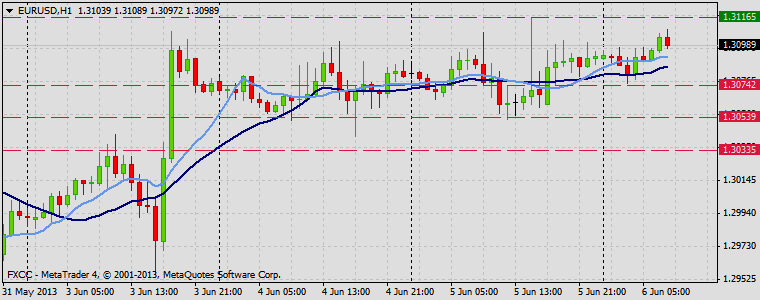

EUR Prime for a Breakout on ECB The euro is prime for a breakout. Unlike other major currency pairs, EUR/USD traded in a relatively tight range throughout the European and North American sessions. On a technical basis, the currency pair stayed between the 100 and 200-day SMAs for the past 48 hours, which reflects the hesitation of investors who are waiting for a catalyst to take the currency pair out of its range. Tomorrow could be the perfect opportunity for a breakout in the pair with the European Central Bank scheduled to deliver its monetary policy decision. The ECB is widely expected to leave interest rates unchanged leaving Mario Draghi's press conference as the primary focus for FX traders. FOREX ECONOMIC CALENDAR : 2013-06-06 11:00 GMT | BoE Interest Rate Decision 2013-06-06 11:45 GMT | ECB Interest Rate Decision 2013-06-06 12:30 GMT | ECB Monetary policy statement and press conference 2013-06-06 12:30 GMT | USA. Initial Jobless Claims FOREX NEWS : 2013-06-06 05:16 GMT | GBP/USD dealing around 1.54 ahead of BoE 2013-06-06 04:59 GMT | USD lower but holding above 82.50 DXY; Aussie smacked 2013-06-06 04:24 GMT | Economic data set to heighten volatility in EUR/USD 2013-06-06 00:24 GMT | AUD/USD cracks the big 0.95 figure down ---------------------- EURUSD : HIGH 1.31089 LOW 1.30751 BID 1.31005 ASK 1.31009 CHANGE 0.07% TIME 08 : 35:19  OUTLOOK SUMMARY : Up TREND CONDITION : Sideway TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High MARKET ANALYSIS - Intraday Analysis Upwards scenario: EURUSD stabilized after the initial uptrend formation. Potential to move higher is seen above the next resistance level at 1.3116 (R1). Loss here would suggest next intraday targets at 1.3135 (R2) and 1.3155 (R3). Downwards scenario: We would shift our intraday technical outlook to the negative side if the price manage to penetrate below the key support at 1.3074 (S1). Clearance here is required to enable intraday targets at 1.3053 (S2) and 1.3033 (S3). Resistance Levels: 1.3116, 1.3135, 1.3155 Support Levels: 1.3074, 1.3053, 1.3033 ---------------------- GBPUSD : HIGH 1.54157 LOW 1.5381 BID 1.54005 ASK 1.54011 CHANGE -0.03% TIME 08 : 35:20  OUTLOOK SUMMARY : Up TREND CONDITION : Up trend TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : High Upwards scenario: Ascending structure on GBPUSD suggest possible correction ahead though break above the resistance at 1.5418 (R1) is liable to stimulate bullish pressure and validate interim target at 1.5443 (R2) en route final aim at 1.5469 (R3). Downwards scenario: Retracement action is possible if the price manages to overcome our initial support level at 1.5359 (S1). In such case we would suggest intraday targets at 1.5353 (S2) and 1.5327 (S3). Resistance Levels: 1.5418, 1.5443, 1.5469 Support Levels: 1.5359, 1.5353, 1.5327 ------------------------ USDJPY : HIGH 99.466 LOW 98.862 BID 99.348 ASK 99.352 CHANGE 0.29% TIME 08 : 35:21  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: Next hurdle on the upside is seen at important technical level |

|

«

Previous Thread

|

Next Thread

»

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | Search this Thread |

| Display Modes | |

|

|

All times are GMT -5. The time now is 12:19 PM.

Linear Mode

Linear Mode