|

|||||||

|

|

|

Submit Tools | Thread Tools | Search this Thread | Display Modes |

|

|

|

#1

|

|||

|

|||

|

Forex Technical & Market Analysis FXCC Apr 01 2013

Forex Technical & Market Analysis FXCC Apr 01 2013

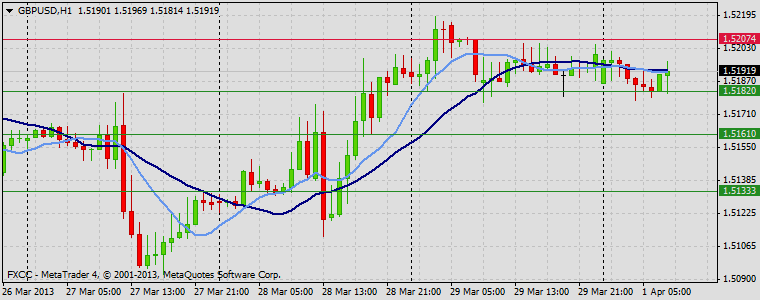

US Data, Italian Politics and Holidays While it has been and will continue to be an exceedingly quiet morning in the foreign exchange market with most of the major markets closed for the Easter holidays, there were still have a few pieces of U.S. data released this morning. Personal income rose 1.1% in the month of February while personal spending rose 0.7%. USD/JPY barely reacted to the news because there's no one trading today but both numbers were better than expected and consistent with a continued recovery in the U.S. economy. The stronger increase in incomes versus spending is also a healthy trend that makes the light at the end of the tunnel shine slightly brighter for the Federal Reserve. The final University of Michigan Consumer Confidence numbers will be released later this morning but no revisions are expected and so the data should be a nonevent for the U.S. dollar. Now that the situation in Cyprus has been pacified, the focus in Europe has shifted back to Italy where there were rumors that Berlusconi is open to a coalition with Bersani. He has since denied this possibility, saying instead that a grand coalition with an agreement on program reforms is the only acceptable option. Recent polls suggest that 50% of Italians are ready to vote again. - FOREX ECONOMIC CALENDAR : 2013-04-01 14:00 GMT | USA.Construction Spending (MoM) (Feb) 2013-04-01 14:00 GMT | USA.ISM Manufacturing PMI (Mar) 2013-04-01 14:00 GMT | USA.ISM Prices Paid (Mar) 2013-04-01 22:30 GMT | AU.AiG Performance of Mfg Index (Mar) FOREX NEWS : 2013-04-01 04:31 GMT | EUR/USD offered below 1.28; Italy and Cyprus main focus 2013-04-01 04:06 GMT | GBP/USD, premature to abandon bullish H&S pattern - BBH 2013-04-01 02:59 GMT | AUD/JPY lowest in 2 weeks, holds above 97.50 2013-04-01 01:26 GMT | USD/JPY dips further, 94.00 holds --------------------- EURUSD : HIGH 1.28129 LOW 1.2771 BID 1.27834 ASK 1.27842 CHANGE -0.25% TIME 08 : 02:10  OUTLOOK SUMMARY : Down TREND CONDITION : Down trend TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium MARKET ANALYSIS - Intraday Analysis Upwards scenario: The recent price acceleration on the upside suggests a possible move higher ahead. Next on tap is resistive barrier at 1.2810 (R1) on the way towards to higher targets at 1.2844 (R2) and 1.2866 (R3). Downwards scenario: Although market players may prefer to increase exposure on the short positions and push the price below the support level at 1.2768 (S1). Possible price devaluation would suggest next initial targets at 1.2742 (S2) and then 1.2701 (S3). Resistance Levels: 1.2810, 1.2844, 1.2866 Support Levels: 1.2768, 1.2742, 1.2701 ------------------------- GBPUSD : HIGH 1.52018 LOW 1.51777 BID 1.51892 ASK 1.51904 CHANGE -0.07% TIME 08 : 02:10  OUTLOOK SUMMARY : Down TREND CONDITION : Downward penetration TRADERS SENTIMENT : Bearish IMPLIED VOLATILITY : Medium Upwards scenario: Medium-term negative bias pressure the price lower however instrument might find buyers above the important resistance level at 1.5207 (R1). Break here might open route towards to our initial targets at 1.5231 (R2) and 1.5256 (R3). Downwards scenario: Opportunities for bearish oriented traders are seen below the important support level at 1.5182 (S1). Loss here would open door for the downtrend expansion towards to interim targets at 1.5161 (S2) and 1.5133 (S3). Resistance Levels: 1.5207, 1.5231, 1.5256 Support Levels: 1.5182, 1.5161, 1.5133 -------------------------- USDJPY : HIGH 94.373 LOW 93.832 BID 93.943 ASK 93.950 CHANGE -0.28% TIME 08 : 02:11  OUTLOOK SUMMARY : Down TREND CONDITION : Sideway TRADERS SENTIMENT : Bullish IMPLIED VOLATILITY : Medium Upwards scenario: USDJPY maintained a negative near-term tone though recovery action is possible above the next visible resistance at 94.34 (R1). Clearance here might initiate bullish pressure and validate our next targets at 94.59 (R2) and 94.86 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the key support barrier at 93.85 (S1). Only clear break here would be a signal of possible market easing towards to our next targets at 93.60 (S2) and potentially to 93.34 (S3). Resistance Levels: 94.34, 94.59, 94.86 Support Levels: 93.85, 93.60, 93.34 Source: FX Central Clearing Ltd,( ) |

|

«

Previous Thread

|

Next Thread

»

| Currently Active Users Viewing This Thread: 2 (0 members and 2 guests) | |

| Thread Tools | Search this Thread |

| Display Modes | |

|

|

All times are GMT -5. The time now is 12:30 PM.

Hybrid Mode

Hybrid Mode